Tinseltown Tensions: The Holiday Box Office Meets a Wild M&A Plotline

-

Thanksgiving blockbusters boosted Q3 revenues, but attendance still trails the post-pandemic years

-

Studio suspense escalates as Paramount and Netflix circle Warner Bros Discovery in a major M&A showdown

-

Analysts are upbeat about Christmas-time movie releases and anticipated franchise hits into 2026

Lights. Camera. Action! Hollywood was no doubt pleased with the Thanksgiving box office haul. Disney's (DIS) "Zootopia 2" took in an estimated $156 million over the five-day stretch, while Comcast's (CMCSA) Universal's "Wicked: For Good" tallied $93 million in ticket sales. In total, families came out in decent droves, with $300 million in box office revenue.

That figure sounds hearty, but it fell well short of 2024's $420 million-plus sum, although it dwarfed 2023's total. All told, analysts at Wedbush forecast the 2025 North American box office to reach $9 billion, a 5% year-on-year increase. They expect a 9% jump in 2026.

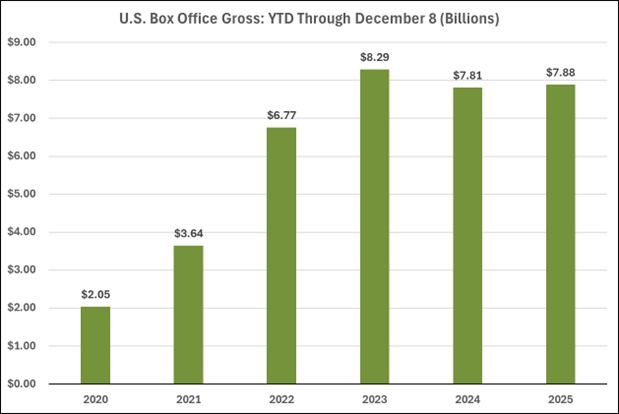

YTD Box Office Sales Steady Since 2023

Source: Box Office Mojo by IMDbPro

Tinseltown's Holiday Tensions

Major studios are looking forward to another slate of potential blockbusters aimed at teens and adults, along with animated hits for the kiddos. But the movie industry is at a crossroads. Artificial intelligence (AI) is a pervasive concern among creatives, with the latest storyline being Disney's $1 billion OpenAI investment (maybe we can create our own Mickey Mouse Soras now!).

What's more, the elephant in the room is the ongoing battle for Warner Bros. Discovery (WBD). Just last week, Paramount submitted a record $77.9 billion hostile bid for Warner after Netflix (NFLX) inked a deal with the longstanding $67 billion market-cap Movies and Entertainment company.

A Corporate Sleigh Ride of M&A Drama

In this game of media thrones, the final script has yet to be written on which outfit claims WBD's assets. The corporate saga has arguably become the biggest M&A story of the year—more dramatic than even this year's Oscar-eligible motion pictures.

The U.S. Department of Justice (DOJ) Antitrust Division and the Federal Trade Commission (FTC) may have to step in, depending on who WBD's preferred suitor will be. President Trump has also entered the fray, an antagonist, telling reporters, "None of them are great friends of mine." Meanwhile, his son-in-law, Jared Kushner, plays a supporting role on behalf of private-equity group Affinity Partners. Three sovereign wealth funds are also involved... an extensive cast of characters to say the least.

A Stocking Stuffer of Box Office Stats

It's a high-stakes plot with plenty of twists. Let's offer some comedic relief (still focused on the data, of course!). So far, the U.S. box office has taken in $7.88 billion in net ticket sales. That's up just 1% from this time last year, while the year-to-date figure remains below the post-pandemic peak of $8.29 billion.

In short, folks still enjoy going to the movies, but it's clear that the proliferation of streaming services has taken its toll on traditional theatrical releases.

Ghosts of Blockbusters Past

According to Box Office Mojo by IMDbPro, among the top-grossing opening-weekend releases annually since 2013, only two hit the big screen after 2019. Sony Pictures' (SONY) "Spider-Man: No Way Home" came in with $260 million just before Christmas 2021, while Disney's "Doctor Strange in the Multiverse of Madness" registered $187 million in May 2022.

The days of Barbenheimer and Taylor Swift's movie debut seem distant. Producers yearn for new viral flicks—are they in the queue? Let's take a sneak preview.

Holiday Releases by the Fire

The final quarter of the year is traditionally the industry's crucial stretch, culminating in the key Christmas-through-New-Year's holiday period. This year's holiday season is pacing well, thanks to "Zootopia 2" and "Wicked: For Good." Universal's "Five Nights at Freddy's 2" scored well over December's first weekend, as well.

A New Year's Blockbuster Countdown

The next big hit could be the December 19 release of "Avatar: Fire and Ash," an American epic directed by James Cameron. If you're planning to catch this one, you may want to grab an extra bag of popcorn—it runs 3 hours and 17 minutes! The sequel to "Avatar 4," the 20th Century Studios film (a Disney asset), taps into the intellectual property (IP) theme that has often been a money-maker for other studios (think Marvel and Minions).

Frosty Forecasts for 2026

As for next year, Disney banks on big numbers from Pixar's animated "Toy Story 5" due out in June, followed by the live-action "Moana" remake in July. Comcast's Universal relies on its Illumination studio successes—"The Super Mario Galaxy Movie" and "Minions 3" arrive at theaters in April and July, respectively.

Warner Bros. has high expectations for franchise entries such as "Dune Messiah" (December 2026) and the ongoing build-out of its DC universe with films like "Supergirl" (June 2026).

Festive Film Lineups

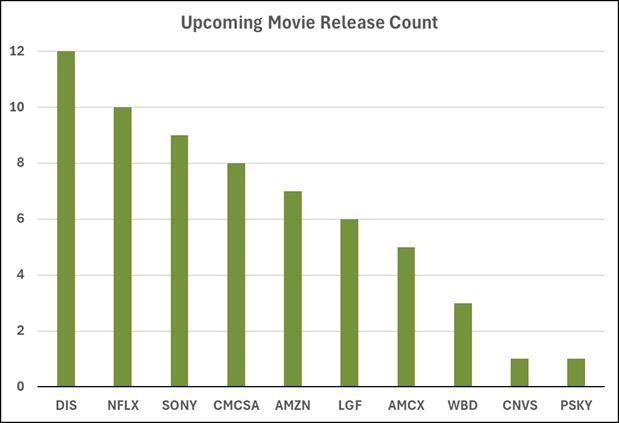

Among confirmed movies through next April, Disney claims the crown for most releases. Hot on its heels is Netflix. Sony Pictures and Comcast Universal also have a steady schedule of features.

Confirmed Movie Release Count Through April 2026

Source: Wall Street Horizon

A Bright Star: IMAX

In terms of stock-market performance, the biggest winner isn't a traditional high-roller Hollywood studio at all, but IMAX Corporation (IMAX). With shares returning 50% YTD through December 8, the $2.1 billion market-cap company noted at its Investor Day earlier this month that its three-year strategic plan is centered on high-margin growth from its global network, premium tech enhancements, and a deeper content slate.

The Consumer-Spending Chill

At the macro level, much hinges on the health of all consumer-spending cohorts. The wealthiest 20% cannot realistically support the theater industry on their own. Improved confidence and spending among lower- and middle-income households is key as we gaze toward 2026.

With a rising unemployment rate and sluggish real wage gains among lower-tier workers, it's not a romantic and rosy view. At the same time, going out to the movies remains a relatively modest-cost family trip, and who can resist those high-margin snacks and a tub of popcorn?

The Bottom Line

We'll call it a steady year for the box office in 2025. A handful of big-time flicks are on deck for the holidays, while studios hope for an improved macro backdrop to drive bigger numbers next year.

Copyright © 2025 Wall Street Horizon, Inc. All rights reserved. Do not copy, distribute, sell or modify this document without Wall Street Horizon's prior written consent. This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this publication, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This publication is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities, including any listed on Toronto Stock Exchange and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. This publication shall not constitute an offer to sell or the solicitation of an offer to buy, nor may there be any sale of any securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. TMX, the TMX design, TMX Group, Toronto Stock Exchange, TSX, and TSX Venture Exchange are the trademarks of TSX Inc. and are used under license. Wall Street Horizon is the trademark of Wall Street Horizon, Inc. All other trademarks used in this publication are the property of their respective owners.