At the Halfway Mark S&P 500 Earnings Defy Headwinds as Tech and Health Care Deliver Strong Q3

-

Q3 Earnings growth continues to improve, with 64% of constituents reporting thus far, S&P 500® EPS growth for Q3 2025 accelerated to 10.7%

-

Potential earnings surprises this week: Eastman Chemical, Martin Marietta Materials, Stanley Black & Decker, ConocoPhillips and more.

-

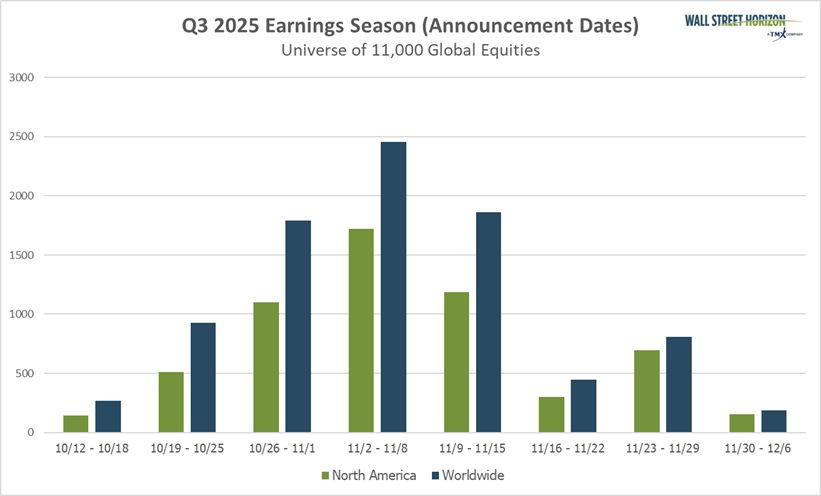

This marks the second peak week of the Q3 earnings season with 3,313 companies set to release results

The Q3 2025 earnings season has concluded for the majority of Big Tech's most dominant players (just NVDA left on November 19!), and the results have confirmed that the AI arms race is in full swing, driving explosive growth for some while leading to staggering costs for others.

In a flurry of reports that ended Thursday, Alphabet, Amazon, Apple, and Microsoft all posted massive, better-than-expected quarters, collectively proving their dominance. However, Meta delivered a sobering reality check, warning that the price of competing on AI will be "notably larger" than anyone imagined, sending its stock tumbling despite strong revenue.

Here's some thoughts on those reports.

The Cloud Kings: Amazon, Alphabet, and Microsoft

For the three companies powering the world's cloud infrastructure, the quarter was a resounding victory, with all signs pointing to their massive AI investments paying off.

On Wednesday came a double-whammy of Alphabet (GOOGL) and Microsoft (MSFT) earnings. Alphabet set a new milestone, reporting its first-ever $100 billion quarter. The company crushed estimates with $102.3 billion in revenue, a 16% jump from the prior year. The star of the show was Google Cloud, which grew a staggering 34% to $15.2 billion as its AI infrastructure and generative AI tools for enterprises gained significant traction. Search and YouTube also posted strong double-digit growth.1

Similarly, Microsoft continued to prove it is successfully monetizing its AI lead. The company beat estimates across the board, driven by a 40% surge in its Azure cloud services revenue. While Microsoft took a $3.1 billion charge related to its massive investment in OpenAI, the partnership appears to be fueling growth across its ecosystem, with strong demand for its AI-powered Copilot products.2

Amazon (AMZN) was the week's biggest surprise, reporting its earnings Thursday afternoon. After months of investor anxiety about slowing cloud growth, Amazon announced that its Amazon Web Services (AWS) division re-accelerated, with revenue jumping 20% to $33 billion. The news, which CEO Andy Jassy said marked a growth pace "we haven't seen since 2022," sent the company's stock soaring 11% in after-hours trading. The company also posted a huge beat on the top and bottom lines, with $180.2 billion in revenue and EPS of $1.95, bolstered by a 24% surge in its high-margin advertising business.3

Meta's AI Spending Spree Spooks Investors

Meta (META) provided the season's sharpest dose of reality. On the surface, the company's report on Wednesday looked strong, with revenue soaring 26% to $51.24 billion and daily active users growing to 3.54 billion. However, the headline numbers were misleading. First, net income plummeted 83%, but this was entirely due to a one-time, non-cash tax charge of $15.93 billion.

The real story that spooked investors was the company's guidance. Meta warned that its capital expenditures in 2026 will be "notably larger" as it builds out its "Meta Superintelligence Labs" to compete in the AI race. The prospect of ballooning costs—with forecasts already hitting $72 billion for 2025—sent the stock down 8% in after-hours trading.4

Apple's Record-Breaking Quarter

Finally, Apple (AAPL) demonstrated its unique resilience by also reporting record numbers on Thursday. Unfazed by the cloud wars, Apple posted its best-ever September-quarter revenue (for its fiscal Q4) of $102.5 billion, an 8% increase year-over-year.

The growth was driven by two key areas: a new September quarter record for iPhone sales and, more importantly, a new all-time record for its high-margin Services division. Apple's performance proves its premium ecosystem remains a powerful and durable fortress, capable of generating massive profits even as its peers battle over the future of AI.5

Beyond Big Tech - Health Care and Energy Reports

While the Mag 7 took the main stage, there were still notable reports from companies in other sectors such as Health Care and Energy.

S&P 500 Health Care companies delivered largely positive results last week, despite being one of the lagging sectors for the Q3 earnings season. Heading into those reports FactSet had a consensus of -4% YoY EPS growth for the sector, with many bellwether companies beating analyst expectations that figure increased to 1.4% by the end of the week.6 This performance has been led by exceptional strength in the pharmaceutical and hospital provider segments. Growth in pharma has been driven by high demand for blockbuster drugs, specifically GLP-1 weight loss drugs (LLY)7, while hospital providers have benefitted from a rebound in patient volumes (HCA, UHS).8 However, the results have been mixed for health insurers, while many have reported strong revenue growth and even raised guidance, they also note they are facing significant profit pressure from medical cost inflation as well as rising utilization (UNH, MOH).9

The week ended with results from two behemoths in the Energy sector. Exxon10 and Chevron11 both reported Q3 results on Friday, beating on the bottom-line, but only Chevron also surpassed top-line expectations while Exxon fell over $1B short of analyst's revenue estimates. Energy is another laggard this quarter, with EPS expected to fall 1.9% YoY, as the oil & gas producers wrestle with lower oil prices.

With the addition of those reports, the S&P 500 blended EPS growth rate stands at 10.7%, up from 9.2% the week prior. According to FactSet, this would be the ninth consecutive quarter of growth. Revenues are now anticipated to grow 7.0% YoY, up from an expectation of 6.6% in the week prior.12

On Deck this Week

This week we get a smattering of results from different sectors, with 3,313 companies expected to report in total, the most of any week this season. Popular names to watch include Palantir (PLTR) on Monday, Uber (UBER) and AMD (AMD) on Tuesday, and Arm (ARM), Qualcomm (QCOM) and McDonald's (MCD) on Wednesday, among others.

Outlier Earnings Dates This Week

Academic research shows that when a company confirms a quarterly earnings date that is later than when they have historically reported, it's typically a sign that the company will share bad news on their upcoming call, while moving a release date earlier suggests the opposite.13

This week we get results from a number of large companies on major indexes that have pushed their Q3 2025 earnings dates outside of their historical norms. Eight companies within the S&P 500 confirmed outlier earnings dates for this week, all of which are later than usual and therefore have negative DateBreaks Factors*. Those names are: Eastman Chemical (EMN), Martin Marietta Materials (MLM), Global Payments (GPN), Stanley Black & Decker (SWK), Bunge Global (BG), ConocoPhillips (COP), Teleflex Incorporated (TFX) and Camden Property Trust (CPT).

* Wall Street Horizon DateBreaks Factor: statistical measurement of how an earnings date (confirmed or revised) compares to the reporting company's 5-year trend for the same quarter. Negative means the earnings date is confirmed to be later than historical average while Positive is earlier.

Q3 Earnings Wave

This week is expected to be the heaviest peak week with 3,077 companies expected to release Q3 earnings results. Currently, November 6 is predicted to be the most active day of the season with 1,173 companies anticipated to report. Thus far, 82% of companies have confirmed their earnings date (out of our universe of 11,000+ global names), and 32% have reported.

Source: Wall Street Horizon

The Bottom Line

As the Q3 earnings season heads into its busiest week, the overwhelming narrative has shifted from macroeconomic anxiety to one of corporate resilience. Despite persistent headwinds and lagging sectors like Energy, the S&P 500 is now tracking for its ninth consecutive quarter of earnings growth, a testament to the sheer strength of its largest members. The blockbuster, AI-fueled results from cloud titans like Amazon, Alphabet, and Microsoft, combined with Apple's ecosystem dominance and surprising resilience in Health Care, have propelled the blended S&P 500 EPS growth expectation to 10.7% with revenue growth at 7.9%—both metrics significantly higher than just a week ago. This season is proving that even in a complex economy, market leaders are finding ways to deliver growth, handily beating expectations and setting a decent tone for the remainder of the year.

1 "Alphabet Announces Third Quarter 2025 Results," October 29, 2025, https://s206.q4cdn.com

2 "Microsoft Cloud and AI Strength Drives Third Quarter Results," October 29, 2025, https://view.officeapps.live.com

3 "Amazon Announces Third Quarter Results," October 30, 2025, https://s2.q4cdn.com

4 "Meta Reports Third Quarter 2025 Results," October 29, 2025, https://investor.atmeta.com

5 "Apple reports fourth quarter results," October 29, 2025, https://www.apple.com

6 FactSet Earnings Insight, John Butters, October 31, 2025, https://advantage.factset.com

7 "Lilly reports third-quarter 2025 financial results," October 30, 2025, https://investor.lilly.com

8 "Universal Health Services Reports Third Quarter 2025 Results, October 27, 2025, https://ir.uhs.com

9 "UnitedHealth Group Reports Third Quarter 2025 Results," October 28, 2025, https://www.unitedhealthgroup.com

10 "ExxonMobil Announces Third-Quarter 2025 Results," October 31, 2025, https://d1io3yog0oux5.cloudfront.net

11 "Chevron Reports Third Quarter 2025 Results," October 31, 2025, https://chevroncorp.gcs-web.com

12 FactSet Earnings Insight, John Butters, October 31, 2025, https://advantage.factset.com

13 Time Will Tell: Information in the Timing of Scheduled Earnings News, Journal of Financial and Quantitative Analysis, Eric C. So, Travis L. Johnson, Dec, 2018, https://papers.ssrn.com

Copyright © 2025 Wall Street Horizon, Inc. All rights reserved. Do not copy, distribute, sell or modify this document without Wall Street Horizon's prior written consent. This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this publication, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This publication is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities, including any listed on Toronto Stock Exchange and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. This publication shall not constitute an offer to sell or the solicitation of an offer to buy, nor may there be any sale of any securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. TMX, the TMX design, TMX Group, Toronto Stock Exchange, TSX, and TSX Venture Exchange are the trademarks of TSX Inc. and are used under license. Wall Street Horizon is the trademark of Wall Street Horizon, Inc. All other trademarks used in this publication are the property of their respective owners.