Jobs Report in Focus as Fed Signals More Rate Cuts

-

All eyes are on the upcoming September jobs report, scheduled for release on Friday, October 3, which follows a much weaker-than-expected reading for August

-

The Federal Reserve is signaling a pivot towards addressing labor market softness, with markets now pricing in a high probability of interest rate cuts in both October and December

-

The report arrives amidst a debate over whether the US is facing a labor supply or demand issue, a situation complicated by corporate layoffs, talent shortages, and shifting immigration policies

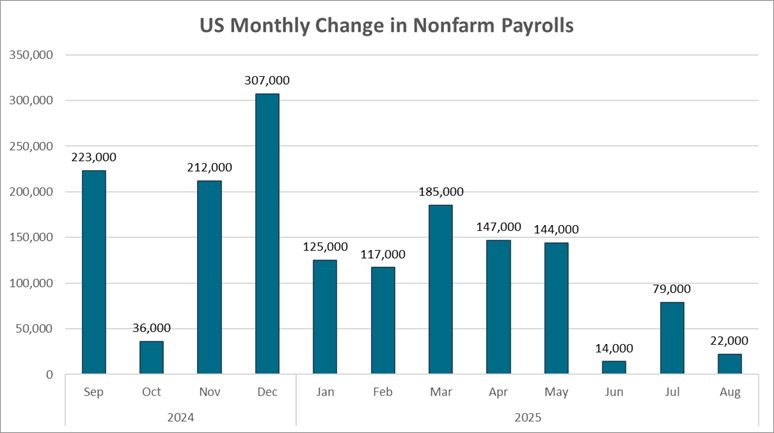

The latest read on the US labor market will be out this Friday, October 3, when the Bureau of Labor Statistics releases September nonfarm payrolls, unemployment, average hourly earnings and other metrics. August NFPs came in softer than expected at 22,000 (vs. the Dow Jones forecast for 75,000) and likely pushed the September 17 interest rate cut over the finish line. That same report saw unemployment tick up to 4.3%, the highest rate in over a year. Wage growth ticked up 0.3% for the month, but the annual gain of 3.7% was lower than the 3.8% expectation. All of these results will be in focus come Friday, as well as the broader measure of unemployment that includes discouraged and underemployed workers, a metric that grew to 8.1% in August, the highest level since October 2021.1

Source: Bureau of Labor Statistics

Leading into that report, we got Initial Jobless claims on Thursday for the week ended September 20. That reading actually fell to 218,000, down 14,000 from the prior week's upwardly revised figure, and significantly less than the estimate for 235,000.2

Fed Focuses on Jobs

The US jobs picture has also become more of a focus for the Federal Reserve. With their attention mostly turned towards combating sticky inflation in the wake of the COVID-19 pandemic, it's clear that addressing the current labor risk through monetary policy is also becoming important to the central bank. During his annual speech at Jackson Hole on August 20, Fed Chairman Jay Powell noted that while the US labor market remains resilient, those risks are creeping up, as are the risks of tariff inflation.3

Since that address, the Federal Reserve did lower interest rates by 25 bps at their September meeting.4 In comments after that rate cut, as well as at a talk in Providence Rhode Island last Tuesday the 23rd, Powell spoke about how recent labor-market softness now outweighs setbacks on inflation. At the latter event, Powell even called the Fed's rate stance "still modestly restrictive," implying there will be further rate cuts this year. He also commented on the challenges the Fed is up against in its mandate to both keep inflation low while supporting healthy labor markets.5

Currently, the CME Group's FedWatch tool has an 88% probability of a 25 bp cut at their October 29 meeting, and a 65% chance of another one at the December 10 FOMC meeting.6

Is the US Labor Market Facing a Supply or Demand Issue?

The state of US employment is interesting in that many are questioning whether we currently face a supply or demand issue. While many large corporations have announced workforce reductions this year, especially in technology, there are others that have reported issues in finding the right talent. The cybersecurity sector for example is facing a talent shortage.7

This labor supply crunch could soon get much worse. The White House's crackdown on immigration is already shaking up the labor market. Potentially exacerbating this issue is the newly proposed $100k fee that corporations could soon have to pay for their employees with H-1B visas, up from a prior fee of ~$2,500.8

The goal of the Trump administration is to drive companies to hire more Americans. Simultaneously the administration is also aiming for robust economic growth and a boom in manufacturing and AI development here in the US, both of which might not be possible without the right amount and type of workers.

Soon we will hear what corporations have to say when they begin reporting Q3 earnings in mid-October, JPMorgan kicks off the season on October 14th. Since late 2020 wage inflation has been an issue hitting companies bottom-lines.

Other US Economic Events to Watch this Week

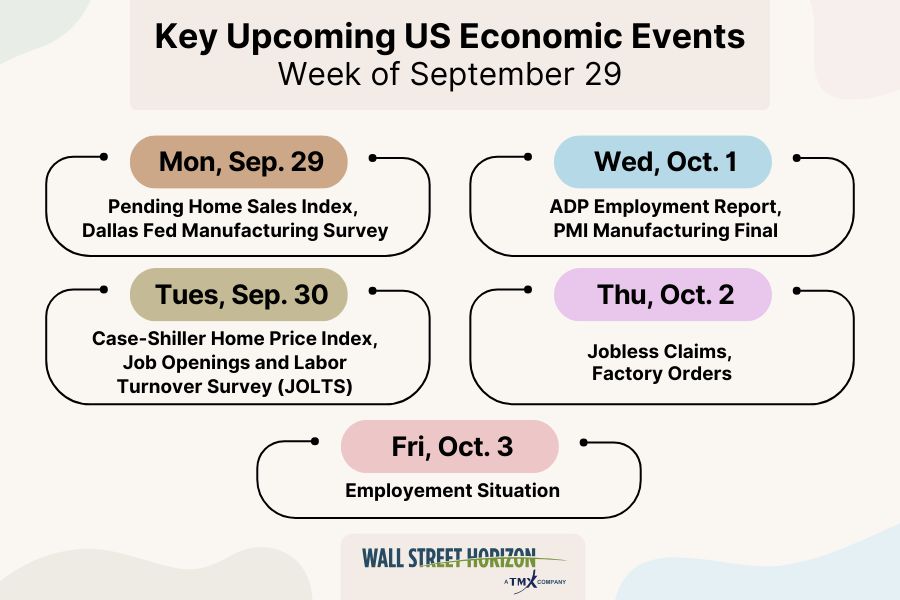

According to our Economic Calendar, data licensed from Econoday Inc., next week we get a slew of other important economic indicators: Case-Shiller Home Price Index and JOLTS on Tuesday, ADP private payrolls and PMI on Wednesday, Initial Jobless claims on Thursday, and of course September Jobs on Friday.

Source: Wall Street Horizon, Data Licensed from Econoday Inc.

The Bottom Line

Ultimately, the September jobs report will serve as a critical verdict for the Federal Reserve. With Chairman Powell already signaling a pivot towards addressing labor market softness, a weak report would all but guarantee an October rate cut and bolster the case for further easing in December. Conversely, a surprisingly resilient number could complicate the Fed's narrative, forcing policymakers to weigh the risks of a weakening job market against still-present inflation. For the market, this Friday isn't just about jobs; it's about the future path of monetary policy.

1 August Employment Situation Summary, US Bureau of Labor Statistics, September 5, 2025, https://www.bls.gov

2 Unemployment Insurance Weekly Claims, Department of Labor, September 25, 2025, https://www.dol.gov

3 Monetary Policy and the Fed's Framework Review, Federal Reserve, August 22, 2025, https://www.federalreserve.gov

4 Federal Reserve issues FOMC statement, September 17, 2025, https://www.federalreserve.gov

5 "Powell Describes Rates as ‘Modestly Restrictive,' Keeping Door Open to Cuts," Wall Street Journal, Nick Timiraos, September 23, 2025, https://www.wsj.com

6 CME Group's FedWatch tool, https://www.cmegroup.com

7 The Cybersecurity Crisis: Companies Can't Fill Roles, Workers Shut Out, Forbes, Emily Sayegh, February 5, 2025, https://www.forbes.com

8 "Trump Says the U.S. Will Institute $100,000 Fee for Skilled Worker Visas," New York Times, Tyler Pager and Hamed Aleaziz, September 19, 2025, https://www.nytimes.com

Copyright © 2025 Wall Street Horizon, Inc. All rights reserved. Do not copy, distribute, sell or modify this document without Wall Street Horizon's prior written consent. This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this publication, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This publication is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities, including any listed on Toronto Stock Exchange and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. This publication shall not constitute an offer to sell or the solicitation of an offer to buy, nor may there be any sale of any securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. TMX, the TMX design, TMX Group, Toronto Stock Exchange, TSX, and TSX Venture Exchange are the trademarks of TSX Inc. and are used under license. Wall Street Horizon is the trademark of Wall Street Horizon, Inc. All other trademarks used in this publication are the property of their respective owners.