The Earnings Party Hits a Wall: Strong Q2 Profits Can't Overcome Macro Fears

-

As we enter the second week of peak earnings season for Q2, S&P 500 EPS growth continues to improve, now at 10.3% YoY

-

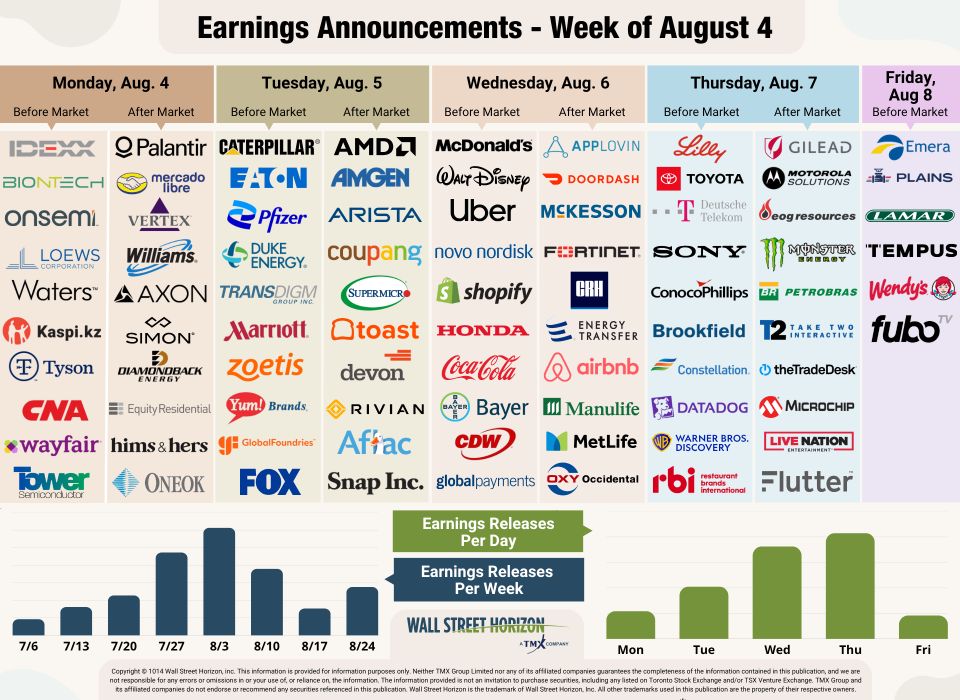

We'll get a closer read on the AI trade this week when Palantir and AMD report

-

Several S&P 500 companies reporting this week have delayed their earnings dates, including: Pfizer, McDonald's, GoDaddy and ConocoPhillips.

Another week of stellar earnings led to the S&P 500 and Nasdaq Composite hitting record levels by Thursday, but what a difference a day makes. By Friday, disappointing Nonfarm payrolls for July (73,000), as well as downward revisions to May and June figures1, sent markets in a tailspin and prompted President Trump to fire the commissioner of labor statistics.2 Add to that strained US-Russia relations3 and a tariff deadline4, and both the S&P 500 and Nasdaq ended the week down 2.5%.

The earnings party started after-the-bell on Wednesday when both Meta and Microsoft blew expectations out of the water for the second quarter, and provided better-than-expected guidance.

Once again, heavy investments in AI were rewarded by investors, both companies have focused on increasing capex to build out AI infrastructure and capabilities and said they will continue to do so. Meta expects 2025 capex in a range of $66-72B, increasing the lower end of the company's previous estimate of $64 - $72B.5 Microsoft said they expect over $30B of capex in the first fiscal quarter, higher than the roughly $25B FactSet analysts were anticipating.6 Those results helped both stocks rocket higher, with Meta shares up 12% by the close on Thursday, and Microsoft up 5%.

Next up were results from Apple and Amazon. Of these two, Amazon was expected to be the standout due to strength from AWS, but when revenue figures from the company's cloud service underwhelmed investors, especially in comparison to the growth rivals such as Alphabet and Microsoft have seen, the stock fell 7% the next trading day.7 Apple on the other hand, long criticized for its lack of AI investment, beat their FQ3 earnings expectations with strong iPhone sales.8 That was enough to send the stock up 2% in pre-market trading Friday, but that eventually fell apart along with other stocks that day.

With the results from those names as well as the 160 other S&P 500 constituents that reported last week, Q2 growth propelled to 10.3% from 6.4% the prior week. Revenues fell slightly to 4.9% from 5.1% the week prior. Beat rates remain impressive with 82% of S&P 500 companies surpassing expectations on the bottom-line and 79% on the top-line, better than the 1, 5, and 10-year beat rate averages according to FactSet.9

On Deck this Week

This week threads of the AI trade will continue to appear in reports from Palantir and Advanced Micro Devices, both of which saw their stocks move higher after reports from Meta and Microsoft. We'll also begin to hear from consumer driven names such as Lyft, Uber, McDonald's, Airbnb, Disney and Yum! Brands.

Source: Wall Street Horizon

Outlier Earnings Dates This Week

Academic research shows that, when a company confirms a quarterly earnings date that is later than when they have historically reported, it's typically a sign that the company will share negative news on their upcoming call, while moving a release date earlier suggests the opposite.10

This week we get results from a number of large companies on major indexes that have pushed their Q2 2025 earnings dates outside of their historical norms. Ten companies within the S&P 500 confirmed outlier earnings dates for this week, all of which are later than usual and therefore have negative DateBreaks Factors*. Those names are Aflac (AFL), Eaton Corporation (ETN), DuPont de Nemours (DD), Public Service Enterprise Group (PEG), Pfizer (PFE), APA Corporation (APA), McDonald's (MCD), GoDaddy Inc. (GDDY) and ConocoPhillips (COP).

* Wall Street Horizon DateBreaks Factor: statistical measurement of how an earnings date (confirmed or revised) compares to the reporting company's 5-year trend for the same quarter. Negative means the earnings date is confirmed to be later than historical average while Positive is earlier.

Q2 Earnings Wave

The peak weeks of the Q2 earnings season are expected to fall between July 28 - August 15, with each week expected to see over 2,000 reports. Currently, August 7 is predicted to be the most active day with 1,283 companies anticipated to report. Thus far, 79% of companies have confirmed their earnings date, and 34% have reported (out of our universe of 11,000+ global names), so this is subject to change. The remaining dates are estimated based on historical reporting data.

Source: Wall Street Horizon

1 July Employment Situation Summary, Bureau of Labor Statistics, August 1, 2025, https://www.bls.gov

2 "Trump fires commissioner of labor statistics after weaker-than-expected jobs figures slam markets," CNBC, Jeff Cox, August 1, 2025, https://www.cnbc.com

3 "Trump says he moved two nuclear submarines after Russia's Medvedev warns U.S.," CNBC, Dan Mangan, August 1, 2025, https://www.cnbc.com

4 "Stock markets take a big hit following Trump's tariff plans. Here's what you should know," CNN, August 1, 2025, https://www.cnn.com

5 Meta Reports Second Quarter 2025 Results, July 30, 2025, https://s21.q4cdn.com

6 Microsoft Cloud and AI Strength Fuels Fourth Quarter Results, July 30, 2025, https://www.microsoft.com

7 Amazon.com Announces Second Quarter Results, July 31, 2025, https://ir.aboutamazon.com

8 Apple reports third quarter results, July 31, 2025, https://www.apple.com

9 FactSet Earnings Insight, John Butters, August 1, 2025, https://advantage.factset.com

10 Time Will Tell: Information in the Timing of Scheduled Earnings News, Journal of Financial and Quantitative Analysis, Eric C. So, Travis L. Johnson, Dec, 2018, https://papers.ssrn.com

Copyright © 2025 Wall Street Horizon, Inc. All rights reserved. Do not copy, distribute, sell or modify this document without Wall Street Horizon's prior written consent. This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this publication, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This publication is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities, including any listed on Toronto Stock Exchange and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. This publication shall not constitute an offer to sell or the solicitation of an offer to buy, nor may there be any sale of any securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. TMX, the TMX design, TMX Group, Toronto Stock Exchange, TSX, and TSX Venture Exchange are the trademarks of TSX Inc. and are used under license. Wall Street Horizon is the trademark of Wall Street Horizon, Inc. All other trademarks used in this publication are the property of their respective owners.