Magnificent 7 Diverge as Peak Earnings Season Puts Spotlight on Big Tech

-

As we enter peak earnings season for the second quarter, S&P 500 EPS growth continues to improve, now at 6.4% YoY

-

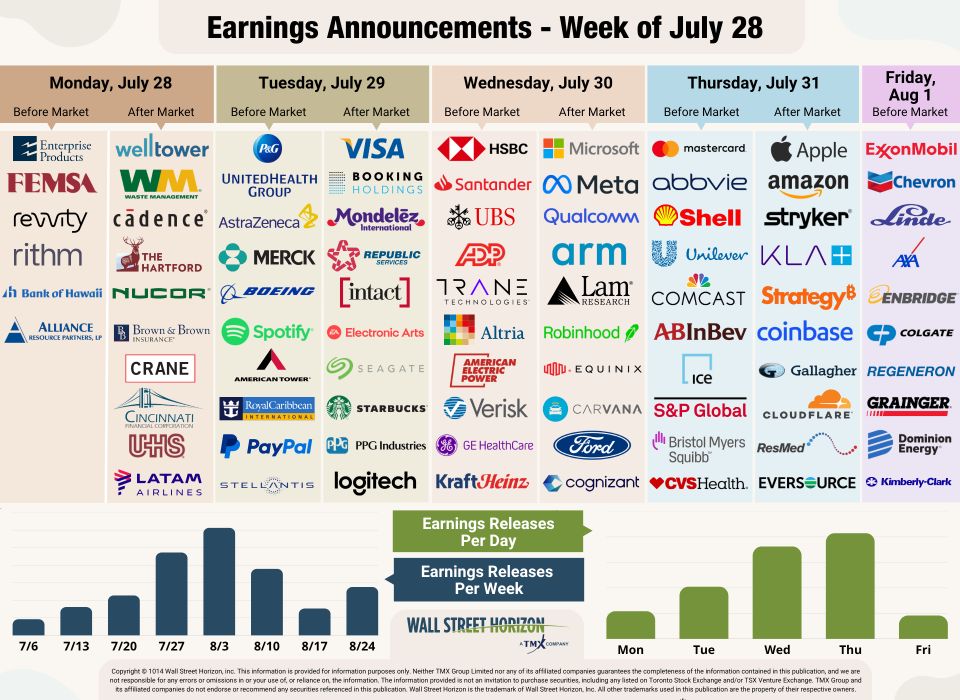

Key tech players from the Magnificent 7 release results this week – Meta and Microsoft on Wednesday, and Apple and Amazon on Thursday

-

Four S&P 500 companies reporting this week have delayed their earnings dates: Teradyne Inc, PPG Industries, UnitedHealth Group, and Kimberly Clark Corp

Peak earnings season for the second quarter begins this week and lasts through the second week of August. This is when roughly 75% of S&P 500 companies are scheduled to report. Thus far 34% of companies from the index have reported, and the early results bode well for the rest of the season.

Last week investors focused on results from the first two Magnificent 7 constituents, Tesla and Alphabet, which both reported on Wednesday and had differing results.

Not surprisingly, Tesla continued to report waning demand. This was expected after the EV maker released disappointing results in their Second Quarter 2025 Production, Deliveries & Deployments on July 2. That report showed that second quarter vehicle deliveries declined 14%, the second straight quarterly decline.1 In their second quarter earnings report, Tesla missed expectations on the top and bottom-line due to automotive revenue which was down 16% YoY, in part due to competition from Chinese EV makers which are producing more affordable models.2 The stock is down ~16% YTD.

On the flipside, Google parent, Alphabet, was a bright spot. Alphabet beat expectations on the top and bottom-line, driven by robust revenue from YouTube advertising and Google Cloud. The company also offered 2025 CapEx estimates that were higher than Wall Street’s expectations for the second time this year. In February, Alphabet said it expected to spend $75B in capital expenditures (CAPEX) mainly due to the expansion in its AI capabilities, which was higher than the $58.84B analysts had expected. Last week that number rose to $85B, this time due to “strong and growing demand for our Cloud products and services.” Alphabet CFO, Anat Ashkenazi, told investors to expect further increases to CAPEX in 2026.3 Alphabet stock is up ~2% YTD.

With the results from those names as well as the 110 other S&P 500 constituents that reported last week, Q2 growth propelled to 6.4% from 5.6% the prior week. Revenues also increased to 5.1% from 4.4% the week prior. Beat rates remain impressive with 80% of S&P 500 companies surpassing expectations on the top and bottom-line, better than the 1, 5, and 10-year beat rate averages according to FactSet.4

On Deck this Week - More Big Tech Results

This week all eyes will be on four more Magnificent 7 reports – from Meta and Microsoft on Wednesday, and Apple and Amazon on Thursday. Nvidia is the final of the group to report on August 27.

Source: Wall Street Horizon

Outlier Earnings Dates This Week

Academic research shows that, when a company confirms a quarterly earnings date that is later than when they have historically reported, it’s typically a sign that the company will share negative news on their upcoming call, while moving a release date earlier suggests the opposite.5

This week we get results from a number of large companies on major indexes that have pushed their Q2 2025 earnings dates outside of their historical norms. Eight companies within the S&P 500 confirmed outlier earnings dates for this week, four of which are earlier than usual and therefore have positive DateBreaks Factors*. Those names are Regency Centers Corp (REG), Booking Holdings (BKNG), AES Corp (AES) and CVS Health Corp (CVS). The four companies with negative DateBreak Factors for this week are Teradyne Inc (TER), PPG Industries (PPG), UnitedHealth Group (UNH), and Kimberly Clark Corp (KMB).

* Wall Street Horizon DateBreaks Factor: statistical measurement of how an earnings date (confirmed or revised) compares to the reporting company's 5-year trend for the same quarter. Negative means the earnings date is confirmed to be later than historical average while Positive is earlier.

Q2 Earnings Wave

The peak weeks of the Q2 earnings season are expected to fall between July 28 - August 15, with each week expected to see over 2,000 reports. Currently, August 7 is predicted to be the most active day with 1,291 companies anticipated to report. Thus far, 71% of companies have confirmed their earnings date, and 14% have reported (out of our universe of 11,000+ global names), so this is subject to change. The remaining dates are estimated based on historical reporting data.

Source: Wall Street Horizon

1 Tesla Second Quarter 2025 Production, Deliveries & Deployments, July 2, 2025, https://ir.tesla.com

2 Tesla Q2 2025 Quarterly Earnings Update, July 23, 2025, https://www.tesla.com

3 Alphabet Announces Second Quarter 2025 Results, July 23, 2025, https://abc.xyz

4 FactSet Earnings Insight, John Butters, July 25, 2025, https://advantage.factset.com

5 Time Will Tell: Information in the Timing of Scheduled Earnings News, Journal of Financial and Quantitative Analysis, Eric C. So, Travis L. Johnson, Dec, 2018, https://papers.ssrn.com

Copyright © 2025 Wall Street Horizon, Inc. All rights reserved. Do not copy, distribute, sell or modify this document without Wall Street Horizon's prior written consent. This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this publication, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This publication is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities, including any listed on Toronto Stock Exchange and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. This publication shall not constitute an offer to sell or the solicitation of an offer to buy, nor may there be any sale of any securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. TMX, the TMX design, TMX Group, Toronto Stock Exchange, TSX, and TSX Venture Exchange are the trademarks of TSX Inc. and are used under license. Wall Street Horizon is the trademark of Wall Street Horizon, Inc. All other trademarks used in this publication are the property of their respective owners.